The Currency of Afrobeats and Latin Artist Collaborations

These collaborations are primarily strategic—driven by market opportunities rather than cultural nostalgia.

We’re witnessing an increase in collaborations between African and Latin American artists, which typically leads to questions about their effectiveness and what success looks like. Are these partnerships generating significant revenue? While I have a video version on this topic, here’s a written overview for those who prefer reading.

African artists are increasingly setting their sights on Latin America, not out of cultural nostalgia, but driven by the region's booming market opportunities. With a robust appetite for streaming that rivals India—the world's second-largest streaming market—Latin America presents a promising avenue for export. This growing interest marks a strategic shift for African musicians, who are seeking new audiences in regions with higher ARPU (Average Revenue Per User). As local revenue is hampered by persistent currency devaluation, these artists are turning to international markets for better earning opportunities via streaming.

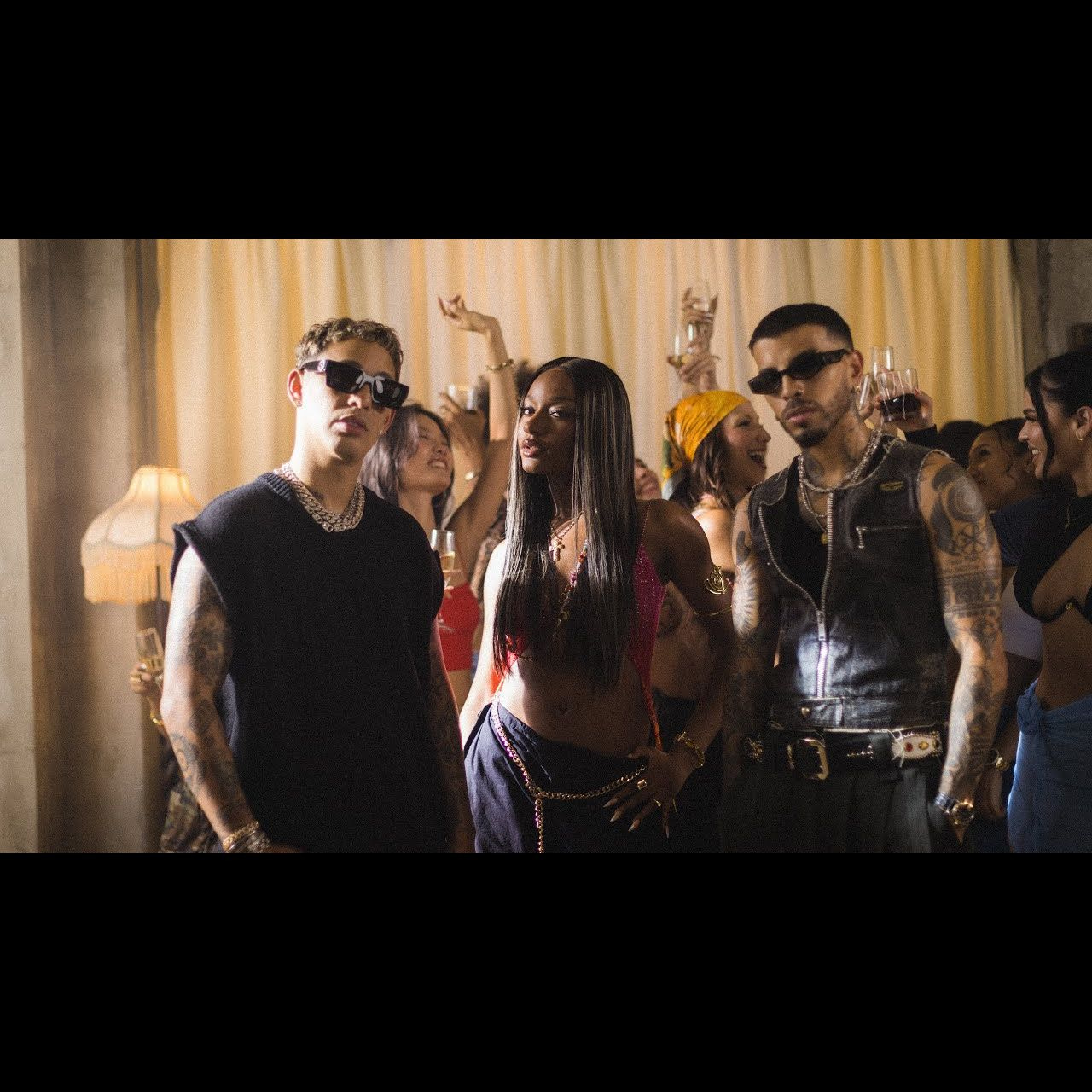

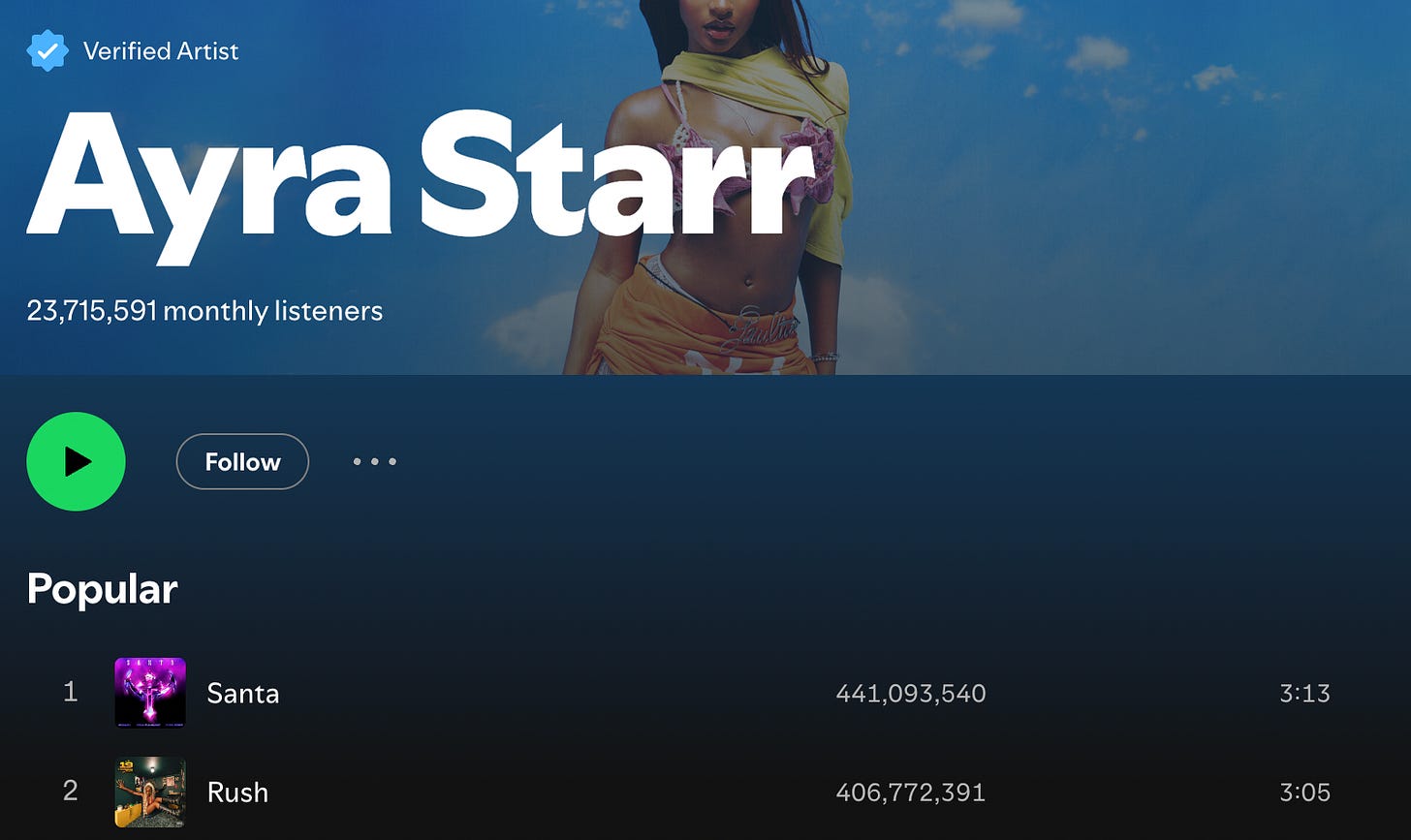

Let’s begin with one of the most notable and recent examples: Santa, a song featuring Nigeria’s Ayra Starr, Jamaica’s Rvssian, and Puerto Rico’s Rauw Alejandro. Released in April, the song has performed exceptionally well on TikTok, surpassing one million video creations. It has been vibed to by prominent figures in Latin-speaking countries, from Puerto Rico to Mexico, and currently boasts about 350 million streams on Spotify. Santa is on track to outpace Rush as Ayra Starr's most-streamed song, even in light of her new album release. If my projections are accurate, it should achieve that milestone before the year ends (it finally has, at the time of writing).

Beyond Spotify, Santa has garnered nearly 100 million views on YouTube, remaining one of the top music videos globally. This means that the song is thriving across multiple platforms, which would mean it's a success through and through. Clearly, African artists are increasingly looking to Latin America, similar to how American artists have traditionally engaged with that market. One major reason for this trend is Latin America’s well-known appetite for streaming, which is comparable to that of India - the second-largest streaming market in the world.

While some music heads might argue that Africa and Latin America share historical ties dating back to European colonization, I believe these collaborations are primarily strategic—driven by market opportunities rather than cultural nostalgia 😅.

I am 100% certain that most stakeholders responsible for bridging the gap between African and Latin American music don’t necessarily consider the cultural history of these regions. Their focus is purely strategic, and that’s fine. After all, American artists have been doing this for a long time, so why can’t Africans?

Now, let’s delve into some interesting insights about such collaborations. Are they effective? Are they yielding good results? What does success look like in this context?

Take Ayra Starr, for instance. When I examined her current most-listened-to countries on Spotify, I found that four out of the top five were Latin-speaking nations, with the only exception being Lagos. I’ve checked this data consistently over the past months, and it’s same.

Clearly, these listeners are not going away anytime soon. Cities like Santiago, Chile, and Lima are part of these top cities, prompting me to dive deeper into her top 50 cities for a closer look.

You know me—I’ll always find a reason to bring up my Excel sheet 😂! I pulled up the numbers and discovered that out of about 47 cities, around 32 were in Latin-speaking countries. That’s nearly 70% of Ayra Starr’s most-listened-to cities right now.

This is precisely what collaborations like these can achieve. Ayra Starr complements this with an effort to connect with that audience as she even wrote in Spanish for some content.

To put this into perspective, Mexico alone has nine cities currently streaming Ayra Starr’s music. In contrast, when we look at her primary markets - which should be Nigeria, there are only three cities—Lagos, Abuja, and Port Harcourt—engaging with her music. It’s striking to see how much broader her reach is in Mexico compared to her home country.

Let’s move to Rema, who also collaborated with Feid, an artist from one of the Latin-speaking countries, last year on a song titled “Bubalu.” Currently, “Bubalu” ranks as Rema's third most popular song on Spotify, trailing only behind the two versions of “Calm Down.”

Despite the release of Rema’s recent album, “Bubalu” continues to maintain its position as his third most popular track. When examining his most-listened-to cities, it’s obvious that at least one Latin-speaking country consistently appears in the mix.

In his top fifty cities, I’ve spotted locations like Mexico City and Lima, along with several others from the Latin American region. Also, “Bubalu” even reached the number one spot on a Billboard Latin chart.

Next up is Joeboy, whose second most popular song on Spotify right now is “Lowkey,” a collaboration with artists from Colombia and Argentina.

When you check his top cities, you’ll find places like Mexico City and Lima, Peru.

Clearly, these collaborations are yielding results. As I mentioned earlier, Latin Americans have a well-known appetite for streaming music. In terms of revenue, while they may not match the performance of North America or Europe, they’re certainly faring better than Africa. It's common knowledge that Latin America ranks as Spotify's third-largest market in terms of premium subscriptions—the bucket where the real money is.

In fact, countries like Chile reportedly generate as much revenue as the entire African continent combined. The revenue generated locally has not been particularly encouraging, especially in light of the significant devaluation of the Naira. Our report indicates that Nigeria experienced a staggering 76.89% drop in the value of Spotify subscriptions, marking one of the highest declines recorded. As a result, exporting music [through collaborations like these] has emerged as a crucial strategy to compensate for these losses.

What does this mean for artists and stakeholders? It’s time to explore these opportunities. Big shout-out to artists like Mr. Eazi, who explored this strategy early on. Collaborations with Latin American artists could be a worthwhile investment, especially considering the potential revenue gains compared to what you might get from Africa. To consider tapping into these markets, artists should look to artists at their level. Just as we’ve seen successful collaborations within Africa (Ghana, South Africa), it’s worth it to expand our horizons to regions with high ARPU like Latin-speaking countries.

Recently, music analytics firm Chartmetric released a study on "Trigger Cities," which it defines as influential music markets where activities such as social media sharing and playlist inclusion can create significant global ripples, propelling artists to international recognition. These cities are characterized by high population density, strong adoption of streaming services, and vibrant music-sharing behaviors, all of which significantly impact the rate of music-sharing. The study mentions that Latin America boasts the most Trigger Cities, with Mexico City and Santiago leading the pack in terms of monthly Spotify user bases.

Chartmetric also provided actionable Trigger City tactics for artists, marketers, and A&Rs.